On 1 March 2016, Hubei Guangji Pharmaceutical Co., Ltd. (Guangji

Pharmaceutical) (stock code: 000952) released its 2015 financial report, which

showed that the company had turned losses into gains. This was mainly attributed

to rises in the price of its main products, which greatly pushed up net profit.

Revenue:

USD85.70 million (RMB560,355,472), up by 15.33% YoY

Net

profit: USD3.20 million (RMB20,921,469), up by 109.41% YoY

2015 saw no great change for the main businesses of Guangji Pharmaceutical. The

company’s main products are raw materials, including riboflavin sodium

phosphate and riboflavin (pharmaceutical grade, food grade, 98% feed grade, and

80% feed grade) and formulations, including tablets and liquid.

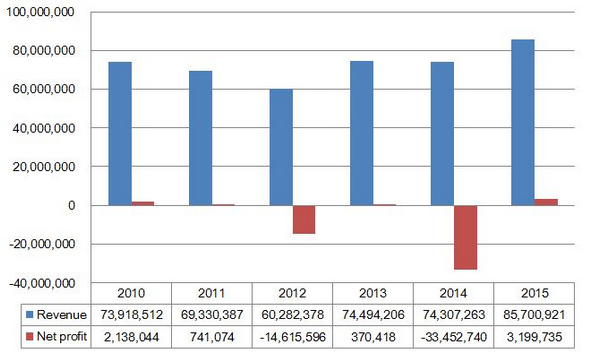

Guangji Pharmaceutical's revenue and net profit, 2010-2015, USD

Source: Hubei Guangji Pharmaceutical Co., Ltd.

In 2015, Guangji Pharmaceutical profited the most from H2, in particular in Q4,

when quarterly net profit reached USD6.20 million (RMB40,545,945.80),

overturning previous losses from Q1-2.

According to Guangji Pharmaceutical's board of directors, reasons for the

turnover are as follows:

Rise

in market prices of vitamin B2 (riboflavin) and vitamin B6 (VB6), driving up

the profitability of products

Sharp

reduction in distribution expenses and administrative expenses, thanks to the

enhancement of internal management

Production

cost decline by 12.1% YoY, because of technological improvements

Guangji Pharmaceutical's revenue and net profit in Q1-Q4, 2015

|

Quarter

|

Revenue,

USD

|

Net

profit, USD

|

|

Q1

|

15,340,035

|

-1,008,873

|

|

Q2

|

12,954,533

|

-2,369,048

|

|

Q3

|

29,176,443

|

376,548

|

|

Q4

|

28,229,910

|

6,201,108

|

Source: Hubei Guangji Pharmaceutical Co., Ltd.

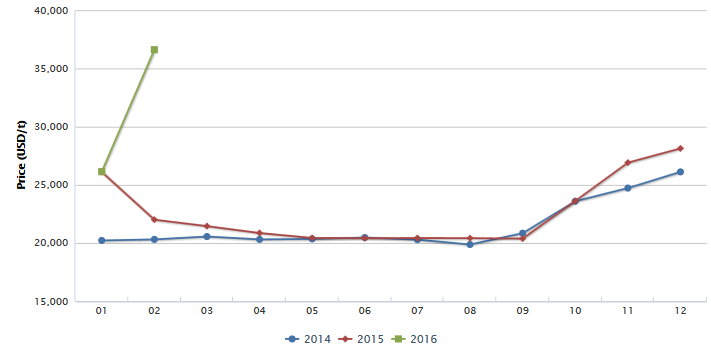

In 2015, the market price of vitamin B2 (VB2) was higher than in 2014, and

since Q4 of 2015, prices have started to rise, according to CCM's price

monitoring.

At the end of June, Guangji Pharmaceutical suspended the production of VB2 in

two factories. Following this, Shanghai Hegno Pharmaceutical Development Co.,

Ltd. (Hegno) and Shandong NB Group Co., Ltd. (Shandong NB) also suspended the

production of VB2 and raised price quotations.

This helped eased oversupply and

paved the way for the price to rebound. Guangji Pharmaceutical is the

largest producer of VB2 in China, accounting for more than 60% of the domestic

VB2 market share. Their VB2 business accounts for more than 70% of the

company's annual revenue.

Guangji Pharmaceutical's subsidiary, Guangji Pharmaceutical (Mengzhou) Co.,

Ltd. is also engaged in the production of VB2. Their total capacity of VB2 is

about 4,500 t/a. Guangji Pharmaceutical's subsidiary, Hubei Guangji

Pharmaceutical Jikang Co., Ltd., is engaged in the production and sale of

medicine formulations. Last year, the rise in the price of VB2 tablets meant a

corresponding rise in the company's net profit.

Another main product of Guangji Pharmaceutical is VB6, whose market price also

rose last year. Guangji Pharmaceutical is a major supplier of VB6 in China, but

the VB6 is actually produced by its subsidiary, Hubei Huisheng Pharmaceutical

Co., Ltd. (Huisheng Pharmaceutical), who have a capacity of 1,000 t/a, and

produce mainly feed grade products.

Currently, Huisheng Pharmaceutical is

applying for GMP (Good Manufacturing Practice) certification, and has finished

the construction of an API production line (Active Pharmaceutical Ingredients),

although the line is not yet up and running. The company's sales volume, sales

prices, net profit, revenue, and profit also increased in 2015.

Market price of 80% feed grade Vitamin B2 in China, Jan., 2014-Feb., 2016

Source: CCM

Market price of 98% feed grade Vitamin B6 in China, Oct., 2014-Dec., 2015

Source: CCM

Guangji Pharmaceutical's prodution lines that need GMP certification, as of

Feb., 2016

|

No.

|

Production

line

|

GMP

certification

|

|

1

|

Large-volume

injections

|

Passed

|

|

2

|

Riboflavin

sodium phosphate API

|

Passed

|

|

3

|

Formulations

(tablets, granules,gels, cream)

|

Passed

|

|

4

|

Vitamin

B2 API

|

Application

processing

|

|

5

|

Vitamin

B6 API

|

Application

preparation

|

Source: Hubei Guangji Pharmaceutical Co., Ltd.

In 2016, the prices of several vitamin varieties have been rising significantly

and the downstream farming industry is rebounding. Because of this, it is

expected that Guangji Pharmaceutical’s business performance will improve this

year. However, the company also faces some huge challenges from stricter

environmental protection policies and from its own simplistic product

structure.

In 2015, in order to improve the company’s public image and increase profits,

Guangji Pharmaceutical recycled wastewater through fermentation and treated factory smell comprehensively.

On the way to Guangji Pharmaceutical becoming a leading enterprise in the Chinese

biological fermentation field, the core problem it faces is the high cost of

environmental protection.

“It is critical for our company to reduce the cost of environmental protection,

and optimize the efficiency of environmental treatment, if we want to

strengthen our biological fermentation business," said Chen Feibao,

general manager of Guangji Pharmaceutical.

This article comes from Corn Products China News 1603, CCM

About CCM:

CCM is the leading market

intelligence provider for China’s agriculture, chemicals, food &

ingredients and life science markets. Founded in 2001, CCM offers a range of

data and content solutions, from price and trade data to industry newsletters

and customized market research reports. Our clients include Monsanto, DuPont,

Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: pharmaceutical vitamin